NAVIGATING THE ESTATE PLANNING WORLD WITH COMFORT & CLARITY.

HOW CAN WE HELP YOU?

FLORIDA COMPLIANCE

AVOIDING

PROBATE

MINIMIZING

TAXES

IS MY PLAN FLORIDA COMPLIANT?

While it’s true that your out-of-state will or trust remains valid when you become a Florida resident, it’s crucial to recognize that estate planning isn’t a one-size-fits-all endeavor. Florida’s estate planning laws are distinct, and failing to update your plan after becoming a resident here can lead to unintended and costly consequences.

To illustrate, let’s explore Florida’s specific descent and devise rules related to homestead property. You’ll quickly grasp how a plan that once served you well in another state may no longer align with the intricacies of Florida law, potentially resulting in complex and expensive challenges.

DOES MY PLAN AVOID PROBATE?

Looking to sidestep the cumbersome process of probate? You’re in the right place. While many people think a simple will is enough, savvy estate planners know that a revocable living trust is the gold standard for avoiding probate. But it’s not just about setting up the trust; it’s about funding it correctly. By transferring the title of your assets into your trust, you ensure a seamless transition of your legacy.

Don’t worry about losing control; you remain the master of your financial destiny. Unlike a Durable Power of Attorney, which can be a hassle to enforce, a fully funded trust offers a smooth handover, even in cases of disability. So why settle for less? Make probate a word of the past and take control of your legacy today.

HOW CAN I ACCESS ESTATE PLANNING RESOURCES?

Welcome to our Learning Hub, your one-stop resource for mastering the intricacies of estate planning in Florida. Immerse yourself in hours of educational content, all curated by Florida Bar Board-Certified professionals. Whether you’re new to estate planning or looking to refine your existing strategy, our comprehensive library has something for everyone.

Browse through a wealth of blogs, podcasts, videos, and articles designed to equip you with the actionable insights and practical advice you need. Don’t leave your legacy to chance; empower yourself with the expert knowledge to take control of your future today.

ELIMINATE CAPITAL GAINS

A new Florida Law enables a complete step-up in tax cost basis at the passing of the first spouse, effectively ELIMINATING CAPITAL GAINS.

ESCAPE YOUR FORMER STATE'S TAX AUTHORITY

Becoming a Florida resident is easy, escaping your former state’s taxing authority is hard.

MORE ESTATE PLANNING TIPS

Subscribe to our online series providing Florida Estate Planning Strategies and Tax Advice

THINGS TO KNOW

A new Florida Law enables a complete step-up in tax cost basis at the passing of the first spouse ELIMINATING CAPITAL GAINS.

Becoming a Florida resident is easy, escaping your former state's taxing authority is hard.

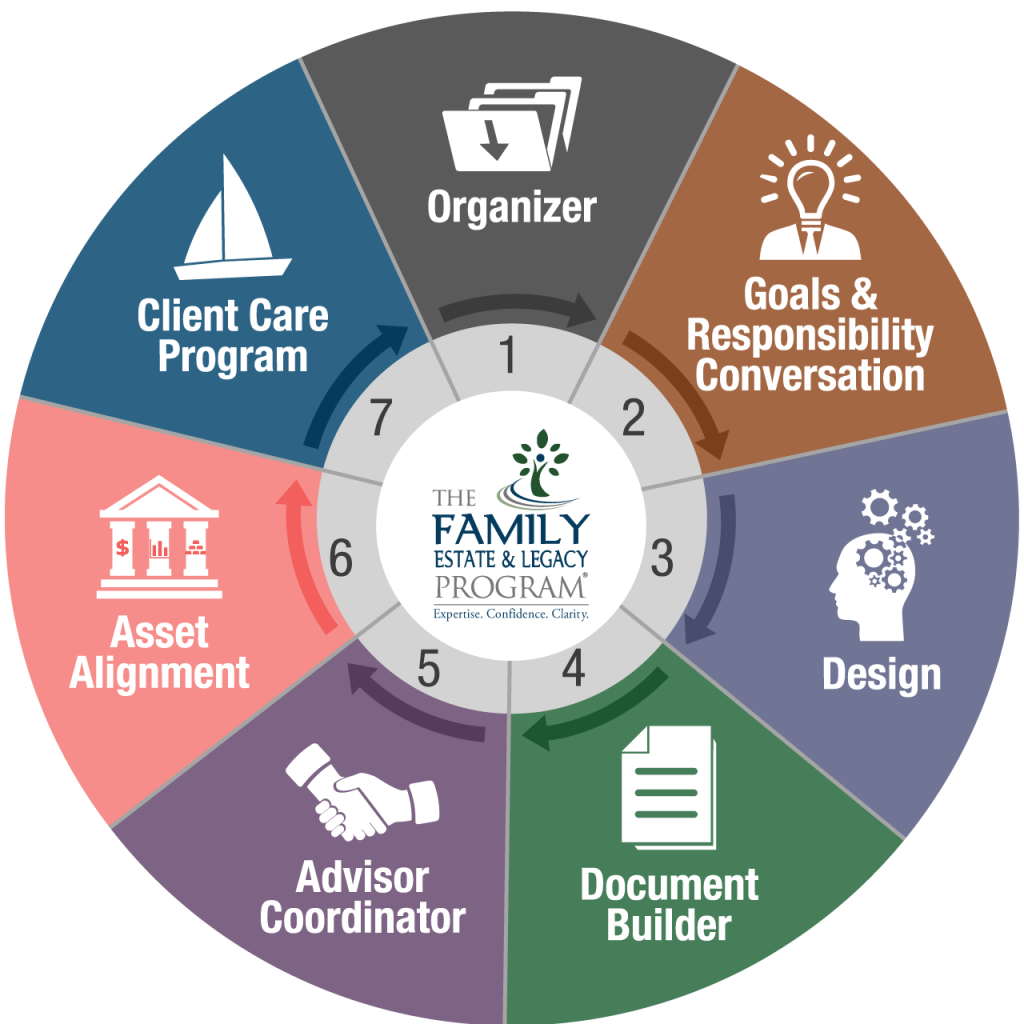

OUR SEVEN STEP PROCESS

Created by our Florida Board-Certified Estate Planning Attorneys, our Family Estate & Legacy Program guides you through the creation of the best estate plan for you & your loved ones.

CREATING

We create an all-encompassing estate plan tailored exclusively to your unique situation

MAINTAINING

Our Florida Board-Certified Wills, Trusts, & Estates Attorneys constantly monitor the law to ensure your estate plan is compliant and fully capitalizing on changes in Florida Law

ADMINISTERING

We ensure that your loved ones get the comfort and clarity they deserve when they need it most.

WHAT OUR CLIENTS

ARE SAYING

YOUR ESTATE PLANNING TEAM

Craig R. Hersch

SENIOR PARTNER

Florida Bar Board Certified Wills, Trusts & Estates Attorney, CPA

michael b. hill

PARTNER

Florida Bar Board Certified Wills, Trusts & Estates Attorney

HAYLEY E. DONALDSON

PARTNER

Florida Bar Board Certified Wills, Trusts & Estates Attorney, CPA

devin j. mace

ASSOCIATE

Wills, Trusts & Estates Attorney